In a previous blog post, we touched briefly on the issue of hospital-based employment versus private practice. Physician employment trends have seen drastic changes in recent years, with a myriad of factors leading the change. This post will shed some light on exactly what differentiates hospital employment and private practice, and the practical implications on physicians’ lives and careers.

Employed vs. Not Employed?

Whether you are an established, working physician or a young doc just finishing training, you have probably either read or heard – physicians are seeking “employed positions” at higher rates than ever before. You may be wondering, what exactly does this mean? What is the alternative to being “employed?” For physicians, there are generally two different routes to take when searching for a job: either as an employee working for a hospital/large organization, or entering private practice (either as a partner in a group or as a solo practitioner). Upon joining a private practice, you will be an employee for a period of time (usually two years), and then you will (hopefully!) be offered the opportunity to “buy in” as a partner. While private practice used to be the gold standard for physicians, the climate has drastically changed.

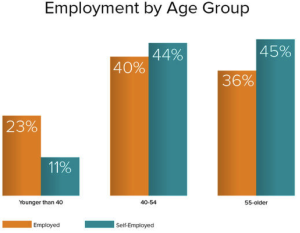

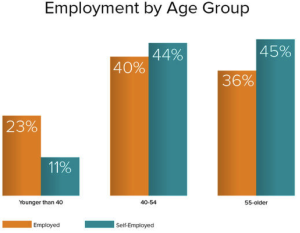

Between 2000 and 2010, the number of physicians employed by hospitals grew by 34%. A 2016 report by Medscape (Read the Medscape report here). showed that roughly 80% physicians today are employed by hospitals, with 20% of physicians reporting a self-employment position. This shift is further evidenced by examining a breakdown based on age. For physicians 55 years and older, 45% are self-employed and 36% are employed. Conversely, for physicians younger than 40, 23% are employed and only 11% are self-employed. However, although older physicians continue to occupy self-employed positions at higher rates, they too are contributing to the shift to employment. Since 2014, the number of older physicians in employed positions has risen by 8 points. Why the shift?

Why the shift?

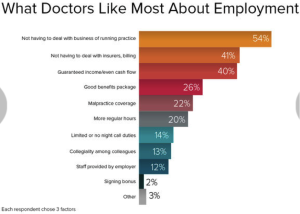

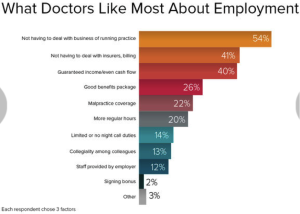

A variety of factors have caused these changes, with health care market dynamics and physician preferences leading the way. To begin with, health care reform and declining reimbursement in many specialties has meant that physicians feel more uncertain than ever about the future. Together with this uncertainty is the fact that many private practices struggle to manage their overhead costs and in many ways, cannot compete with large organizations. Lastly, there appears to be a change in mentality of physicians leaving training wherein their priorities revolve around patient care and their daily practice, rather than any sort of entrepreneurial endeavors. In fact, physicians surveyed about their employed positions overwhelmingly reported that their favorite thing about being employed is “not having to deal with business of running a practice,” with the second leading response being “not having to deal with insurers, billing and other administrative aspects.”

A Breakdown of the Differences

Where and how you are employed can greatly affect everything from the way in which you are paid, to the benefits you receive, to your ability to strike a work/life balance. Below is a breakdown of some of the most significant aspects of employment and how those aspects might vary based on where you work.

Compensation

Employed Position: Often times, starting salaries offered to physicians in employed positions are higher than those in private practice. Employed physicians are also generally afforded the ability to earn productivity or incentive income in addition to their base salary. As employees of large organizations, employed physicians do not feel financial insecurity and do not fear any possibility of their payroll check bouncing. Lastly, while signing bonuses are typical in both hospital employment and private practice, the bonuses tend to be higher for those in employed positions.

Self-Employment Position: While base salaries may be lower and there may be less opportunity for incentive income, private practice does offer substantial money-making potential. Once a partner in private practice, you are entitled to portions of net profits, and you can also earn additional income from ancillary facilities and services. Although overhead may be high and cash flow might be a concern, private practice certainly has its benefits, not least of which is the many benefits derived from ownership and the equity-stake.

- It is important to note that the 2016 Medscape report indicated that employed and self-employed physicians are satisfied with their incomes at nearly identical rates. 38% of employed physicians reported that they are “satisfied” and 16% reported they are “very satisfied” with their income. Similarly, 36% of self-employed physicians reported they are “satisfied” and 17% reported they are “very satisfied” with their income These satisfaction rates suggest that any perceived differences in compensation are likely either negligible or are off-set by other benefits.

Benefits

Employed Position: Working for a large health system generally means that you will be exposed to less risk in terms of the compensation and benefits that are promised to you. As a hospital employee, you can likely rest assured that the benefits you are offered are comprehensive and that they will not be arbitrarily amended or revoked. Further, employees of large organizations have more certainty that they are being afforded the exact same benefits as their colleagues.

Self-Employment Position: While working for a private practice does not necessarily mean that you will not receive sufficient benefits or that they will be taken away from you, there is generally some more wiggle room for the practice owners to amend benefit plans based on practice needs and improving their bottom line. In some senses, however, the benefits offered may not be as substantial as in an employment setting. For instance, it is normal for physicians to receive reimbursement for their annual CME expenses and expenses associated with professional dues, memberships and subscriptions. A small practice may cap that reimbursement at a lower figure than a large organization. Another important benefit is malpractice insurance coverage. While it is the norm for physicians to have their coverage paid for by the practice or hospital, a private practice may be more inclined to leave the responsibility for tail coverage to the physician.

Restrictive Covenant

Nearly every physician who begins employment, regardless of where, is required to sign some form of restrictive covenant (covenant not to compete) in conjunction with their employment contract and/or partnership agreement. In fact, as attorney agents who specialize in analysis and negotiation of physician employment contracts, we have only ever seen a handful of contracts that did not contain a restrictive covenant.

The validity and enforceability of a restrictive covenant depends on state law, and the precise terms and restrictions of covenants vary. Whether a physician goes into employment in a hospital or private practice, it is a near certainty that she will be restricted from certain behaviors if the employment relationship terminates. The only way to ensure that the restrictive covenant is as least restrictive as possible - and therefore most favorable to the physician – is to have it reviewed and negotiated by an attorney experienced in these matters.

Work/Life Balance

Employed Position: One of the benefits of working as an employee is the comfort that comes with having your duties and obligations clearly defined, and therefore limited. In general, employed physicians report that they have a better work/life balance than their self-employed counterparts. Part of this work/life balance is the fact that employed physicians generally enjoy more regular hours than self-employed physicians, and therefore can rely on time away from work. Further, employed physicians generally have less on-call responsibilities than self-employed physicians. Notably, however, despite the favorable regularity in hours, employed physicians report that what they dislike most is that they do not have control over their hours and are completely subject to management’s direction and rules. In other words, they lack autonomy.

Self-Employment Position: For anyone who is self-employed, no matter what the field of work, there is always a certain level of autonomy and freedom. Self-employed physicians report satisfaction with their ability to “practice medicine my way” and have a higher level of control over their schedules. Certainly, this autonomy comes at somewhat of a cost. Self-employed physicians often carry much more personal responsibility and are required to partake in business management aspects that employed physicians never experience. It appears that self-employed physicians are happier and more satisfied than employed physicians, which may be a result of their enjoyment of having control. 63% of self-employed physicians reported that they are satisfied with their work, compared with 55% of employed physicians.

- Interestingly, satisfaction rates among both groups have significantly decreased since 2014, especially for employed physicians. The satisfaction rate for self-employed physicians fell from 74% to 63%, and the satisfaction rate for employed physicians fell from 73% to 55%.

If you are a physician who has received an employment contract offer from a hospital or private practice, and you would like a lawyer to review your contract and assist in negotiating changes to the contract, please call Leigh Ann at 317-989-4833, or email her at loneill@lauthoneill.com.

Why the shift?

Why the shift?